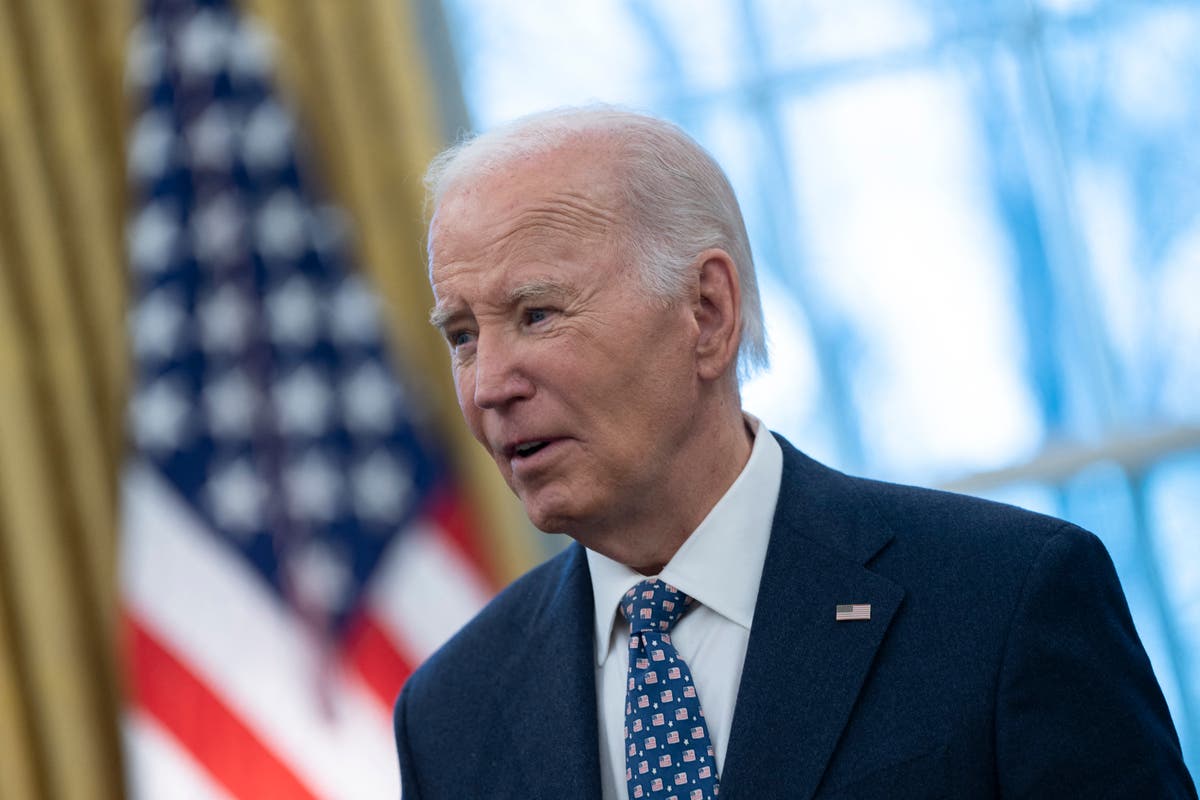

President Biden signed legislation Sunday that will increase Social Security payments for millions of current and former public employees. This landmark change addresses a decades-long inequity in benefits, impacting an estimated three million Americans across various public service jobs.

The Social Security Fairness Act rescinds two provisions – the Windfall Elimination Provision and the Government Pension Offset – that had previously reduced benefits for individuals receiving retirement payments from other sources, including state or local government pensions. This action aims to rectify a system that, critics argue, unfairly penalized public servants.

This reform is expected to boost monthly Social Security checks for affected beneficiaries. The Congressional Budget Office estimates an average increase of $360 per month for those impacted by the Windfall Elimination Provision and an average of $700 for those impacted by the Government Pension Offset. These increases are projected to further rise with regular cost-of-living adjustments.

However, the legislation's passage is not without its challenges. The measure is projected to hasten Social Security's insolvency date, already anticipated for 2035. The increased demand on the already strained Social Security Administration (SSA), which is experiencing its lowest staffing levels in over 50 years, will complicate the implementation of these payments.

Advocates for the change, including public sector unions, applaud the move as a historic step toward fairness and financial security for retiring public servants. They highlight the legislation's impact on individuals who have dedicated careers to their communities.

Conversely, some Republican lawmakers voiced concern about the law's potential long-term impact on the Social Security trust fund. Despite criticism, Republicans have acknowledged the need to address what they perceived as an unfair aspect of existing Social Security policies.

The policy changes outlined in the new law will require significant administrative action from the SSA, potentially adding to already existing backlogs. The agency is already facing a hiring freeze, making efficient processing of payments an ongoing challenge.