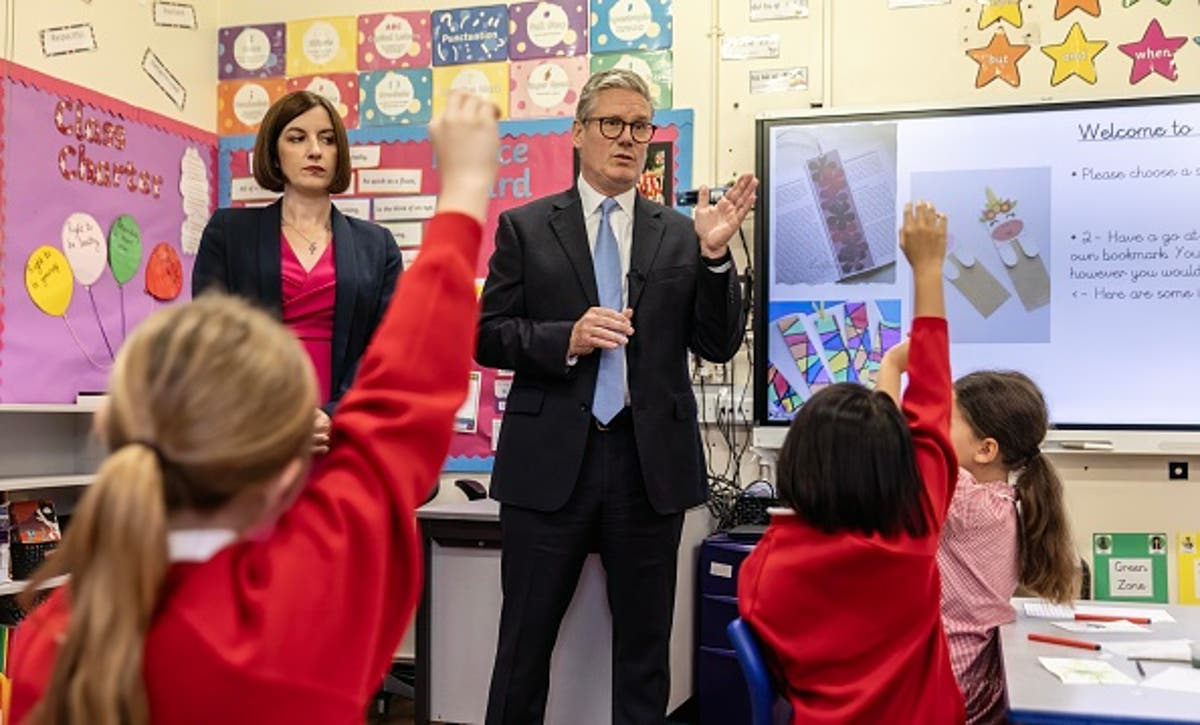

The UK Education Secretary, Bridget Phillipson, has defended the government's controversial decision to end tax exemptions for private schools, asserting it's a necessary move to prioritize investment in state education. This policy, set to take effect this week, will remove charitable status from independent schools, making them subject to VAT.

Phillipson maintains that the change has the backing of middle-class families who find private school fees unaffordable. She argues that this shift will ultimately drive up standards in state schools, directing resources where they are most needed. Moreover, she has stated the current situation is “a luxury we cannot afford”.

However, concerns have been raised regarding potential disruptions. Oxfordshire County Council has warned that families priced out of the private sector may struggle to find state school placements, particularly for students in their final years of secondary education. This has ignited debate about the impact on families and the overall education system.

The Independent Schools Council (ISC) has strongly opposed the measure, branding it a "tax on education" that will adversely affect both private and state schools. They have also threatened legal action against the decision, raising concerns that the increase in fees due to VAT could lead to a surge in students seeking state school places, potentially overwhelming state schools.

Despite criticism, the government stands firm. The Treasury estimates that this policy change will generate £1.7 billion annually by the end of the decade, which will go towards boosting state schools, particularly in special education provision. A total of £2.6 billion has been earmarked for state schools next year with the aim of hiring 6,500 new teachers.

The Liberal Democrats have also expressed reservations about the policy, arguing that it neglects the needs of students with special educational needs currently enrolled in independent schools. There are also concerns from smaller independent schools, with reports of increased parents opting not to accept places offered to their children, likely due to the increased fees.

Labour has dismissed concerns from the private school sector, asserting that they need to adapt to the financial constraints faced by state schools. The party positions the policy as a key step towards improving education standards for all children, ahead of the next general election. The new VAT rules apply to fees paid from July 29 onwards, even for terms beginning in January, preventing parents from pre-emptively paying in advance. Additionally, private schools will lose access to business rates relief for charities, further increasing costs.

In summary, the government is pushing forward with its plan to levy VAT on private school fees, despite warnings about potential negative repercussions on both the state and private sectors, and is defending the policy as a crucial step towards improving state education and is viewed as a necessity.