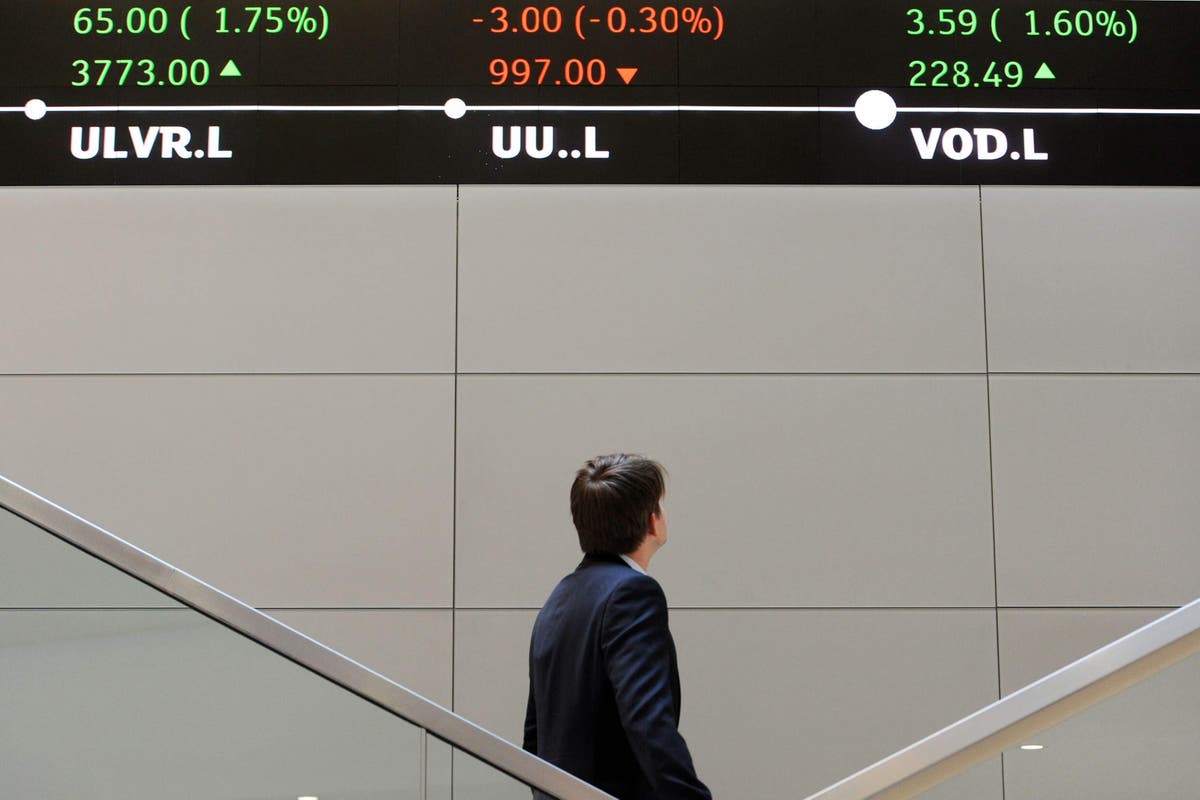

London's stock market experienced a significant exodus of companies in 2024, marking the largest outflow since the 2008 global financial crisis. Auditor EY's data reveals 88 companies delisted or transferred their primary listings from the main market, a dramatic increase compared to previous years. This shift reflects a broader trend of companies seeking more favorable conditions for growth and liquidity elsewhere.

Key factors driving the departures include declining liquidity, lower valuations, and the allure of deeper capital markets, particularly in the United States. Giants like Just Eat Takeaway, Flutter Entertainment, Tui, and Ashtead Group cited these factors when announcing their decisions to move or abandon their UK listings. Flutter's move to the New York Stock Exchange, for example, highlighted the desire to access "the world's deepest and most liquid capital markets."

Meanwhile, the number of new listings, or initial public offerings (IPOs), reached a five-year low in London. Only 18 IPOs materialized last year, significantly lagging behind the number of companies that departed. This decline points to a less favorable environment for companies seeking to enter the London market. Canal+, however, provided a notable exception, raising a substantial £2.6 billion in its IPO, the largest since 2022, and bringing the total proceeds for the year to nearly £3.4 billion.

The data suggests that ongoing geopolitical uncertainties, slow economic growth, and a diminished appetite for domestic equities among investors are all contributing factors to the shift away from London. EY's Scott McCubbin anticipates cautious optimism for 2025, attributing this to potential stabilization in domestic policy and improved listings reform. Nonetheless, companies are expected to closely monitor the market before launching any IPOs.

Globally, despite the London market's struggles, IPO activity saw a slight dip in 2024 compared to 2023. India emerged as the global leader in the number of IPOs, while the U.S. retained its position as the top market in terms of proceeds raised.